What we’re aiming for.

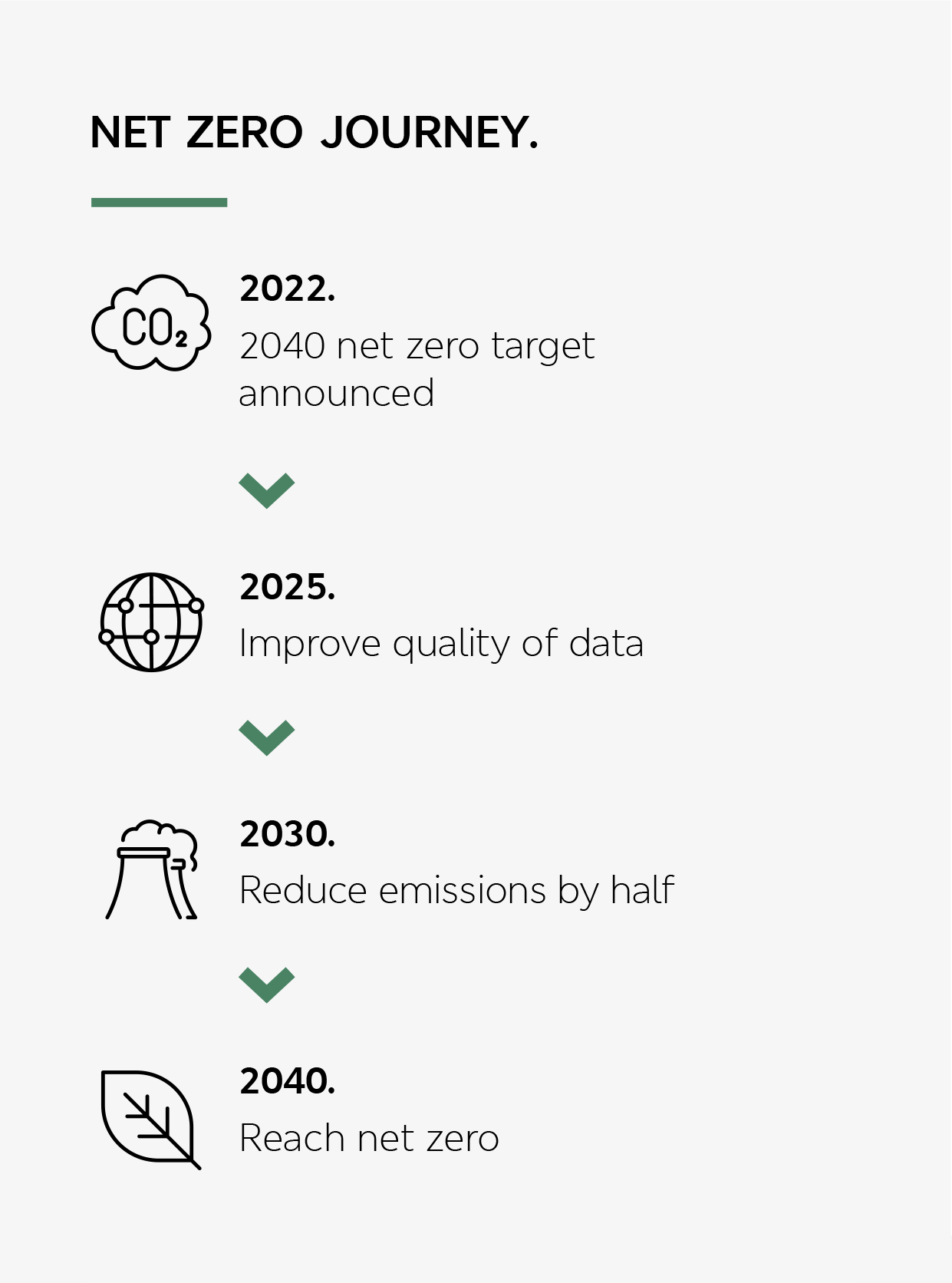

Our long-term target is to provide the ongoing security of the Scheme, reach net zero by 2040 and support better outcomes for everyone. We believe that we can achieve these things and have started work on measuring our impact on the climate and the impact climate change will have on the Scheme. The results of this analysis are in our first Climate Change Report which shows the Scheme’s carbon emissions and looks at how we’ll manage the risks that climate change present.

The main risks to the Scheme from climate change are those that come from societal and economic changes as part of the switch to a low carbon economy (transition risks) and those that come from the physical effects of climate change (such as higher temperatures and more extreme weather). To manage the transition risks we will need to pay attention to how and where we invest the Scheme’s assets.

The physical risks are harder to assess as they will likely take place over a longer period and be influenced by the global response to the climate emergency. We will still seek to manage these risks and play our part in minimising them by working towards our net zero target.

As well as managing the risks to the Scheme from climate change, we want to positively impact the world and mitigate the worst effects of climate breakdown through sustainable investing and reducing our own Scheme emissions.

Our target of net zero by 2040 provides us with a challenging plan to work towards. Actively encouraging the businesses we work with to support this target will be important in reaching this goal and we know that as a large pension scheme we can use our influence to support wider change.

ESG explained

To help you understand more about what we mean when we're talking about ESG and to answer some questions you may have, read our FAQ page.

We value your opinion as we continuously work to improve our service.

HAVE YOU FOUND THIS PAGE HELPFUL?

Yes