RESULTS OF THE LATEST FINANCIAL HEALTH CHECK.

The Scheme is a defined benefit (DB) pension arrangement which means your pension is paid from a single pot, known as the fund.

We keep a close eye on the Scheme’s financial health to make sure there’s enough money set aside in the fund today to make all future pension payments.

We complete an in-depth financial health check known as an actuarial valuation every three years and a yearly financial health check in the years in between actuarial valuations. We ask the independent Scheme Actuary to check the difference between how much the Scheme needs to be able to pay the pensions built up (liabilities) and the total amount set aside in the fund to pay those pensions (assets). It shows whether the Scheme is in surplus and the assets are worth more than the liabilities, or in deficit and the assets are worth less than the liabilities. It's important because it tells us whether the Scheme’s investments are on track or if we need to take action.

It’s useful to keep up to date with this information and we hope it gives you reassurance that the Scheme is well-run and financially secure.

THE LATEST RESULTS

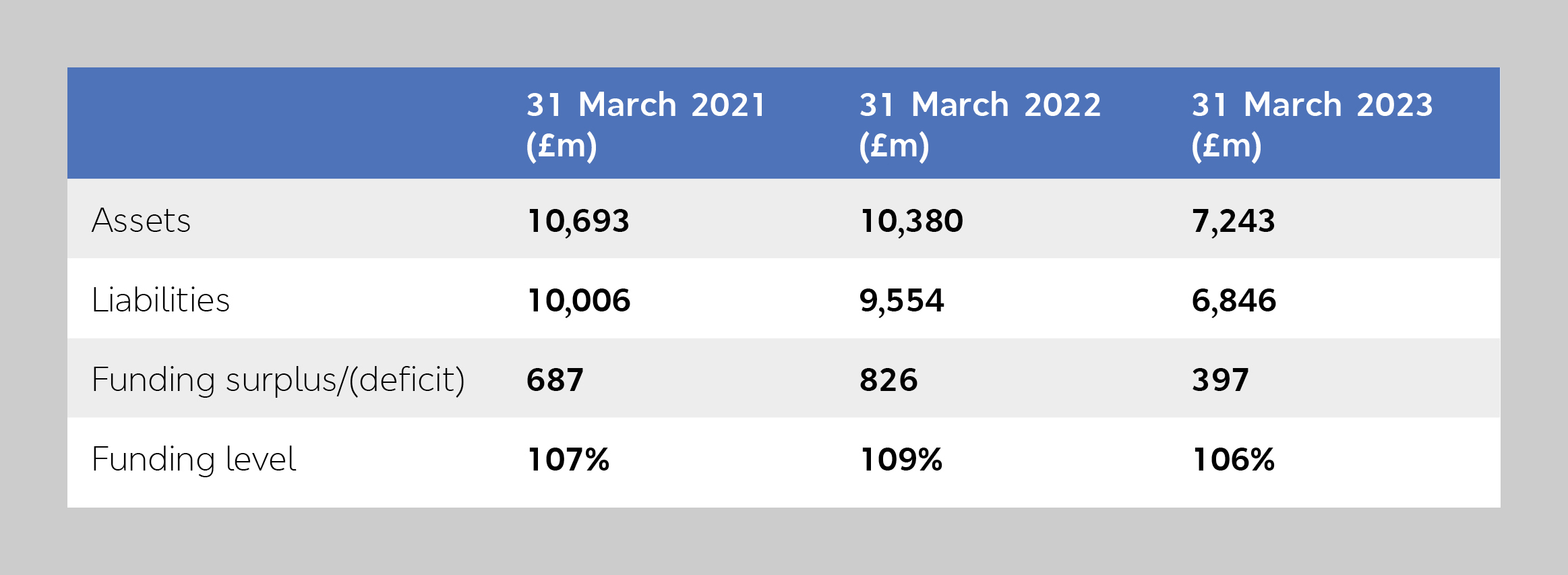

The results of the in-depth financial health check as at 31 March 2021 and the annual health check as at 31 March 2022 and 31 March 2023 were as follows:

We’re pleased to confirm that, despite the challenging financial markets over the year, the Scheme remains in a healthy financial position, with a funding surplus.

Both the Scheme assets and liabilities saw a large drop in value since 2022, which was largely due to significant increases in interest rates. When interest rates increase, the amount the Scheme needs to pay future pension payments reduces. At the same time, the value of certain investments in the Scheme’s assets, such as government bonds and insurance policies, held to match the value of future pension payments, also decrease in value.

As a result, despite the drop in values of the assets and liabilities, the Scheme’s funding level was much more stable. This reflects the Scheme’s investment strategy, which is designed so that movements in the assets and liabilities are broadly matched. The Trustee was also quick to take action to reduce any adverse impact on the Scheme coming out of the market volatility.

We have to pay pensions for a very long time, so a surplus doesn’t mean the Scheme has more money than it needs, but it does tell us the Scheme is currently in a healthy financial position for the future.

WHEN IS THE NEXT FINANCIAL HEALTH CHECK?

The next in-depth financial health check will be calculated as at 31 March 2024. We’ll provide an update on the results after it has been completed.

ADDITIONAL INFORMATION WE MUST TELL YOU.

In the unlikely event that M&S stopped trading and was unable to provide future support to the Scheme, we assume that the Trustee would use the Scheme’s funds to buy members’ pensions from an insurance company that would then pay pensions going forward.

As at 31 March 2021, 82% of the pensions built up in the Scheme would be covered by the money set aside in the fund. This is lower than the funding level because we assume that it costs more to buy pensions from an insurance company.

M&S would be expected to fund the gap, but if it wasn’t able to, the Pension Protection Fund (PPF) might be able to take over the Scheme and pay compensation to members. This compensation is likely to be less than the benefits members are currently entitled to.

We’re including this information as we’re required to consider what would happen if M&S stopped trading, not because we have reason to think that it will.

We must also confirm.

- The Scheme has not made any payments to M&S since the last update provided in 2022.

- The Pensions Regulator has not been required to use any of its powers in relation to the Scheme.

MORE INFORMATION

For detailed information about the latest in-depth financial health check from the Scheme Actuary, members can request a copy of the full Actuarial Valuation Report by contacting the Pensions Administration Team.

To find out more about the PPF go to the PPF website – or write to the PPF at PO Box 254, Wymondham, NR18 8DN.